This is intended for educational purposes only. It is not a recommendation. You should consult your financial advisor before taking any action.

There has been a lot of talk about the Big Beautiful Bill (BBB) that became law last week. The full bill spans more than 870 pages (I get exhausted just thinking about it). The good news is, I went through it so you don’t have to.

The bill touches just about every corner of the economy. If you know where to look, it also opens up some meaningful opportunities for investors. Below I’ve broken down the key parts you should know. We will start with the personal tax changes, then put on our investor hats.

First the personal tax changes

Starting in 2025, you can deduct up to $25,000 of reported tips and up to $12,500 of overtime pay from your taxable income. Taxpayers age 65 and older get $7,600 bonus deduction for the years 2025 through 2028 tax years These benefits phase out for higher earners, but for many people, it means more take-home pay.

The standard deduction also gets a permanent bump:

$15,750 for singles

$23,625 for heads of household

$31,500 for married couples

If you live in a high-tax state (California or New York), you’ll notice another change. The cap on state and local tax (SALT) deductions goes up to $40,000 for households earning under $500,000.

Families and seniors also get a boost. The child tax credit increases to $2,200 per child, and anyone over 65 can claim an extra $4,000 deduction.

There are a few other perks:

Up to $10,000 in deductible interest on U.S.-made car new car loans from 2025-2028

A new “Trump Account” gives $1,000 to every newborn, growing tax-deferred until they turn 18

Now, let’s talk investments

This bill isn’t just about giving people a tax break. It’s also about signaling where the government wants to steer the economy. And as investors, knowing where the money is flowing gives you an edge.

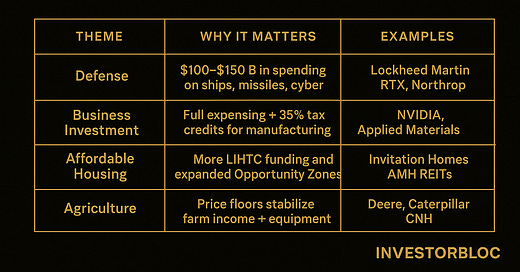

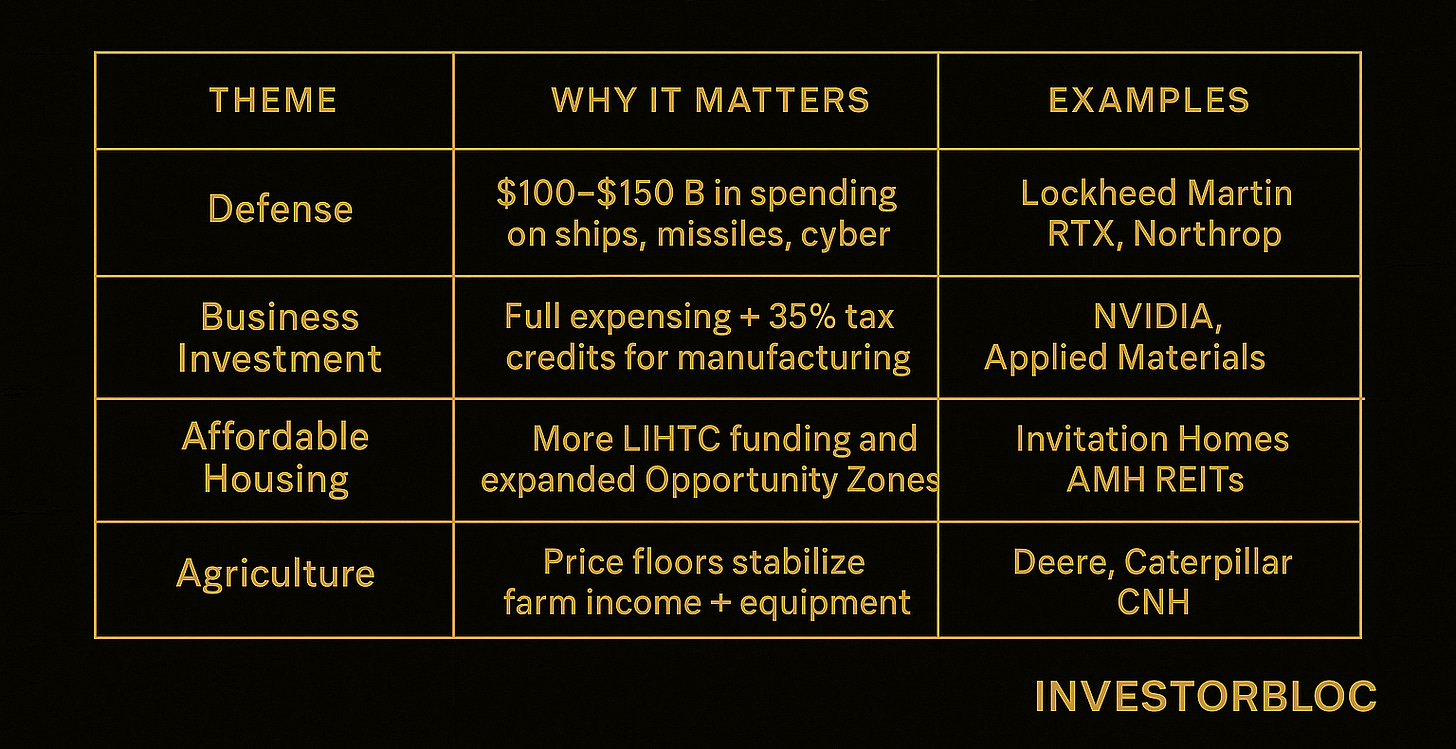

Investment opportunities from the Big Beautiful Bill

Defense spending

The BBB sets aside between $100 and $150 billion for defense. This includes shipbuilding, missile defense and beefing up cybersecurity. The smart move is to watch for companies with consistent government contracts because they tend to benefit the most when budgets like this get passed.

Companies to consider:

Lockheed Martin (Ticker: LMT)

Northrop Grumman (Ticker: NOC)

RTX Corporation (Ticker: RTX)

Business investing

The bill locks in the ability for businesses fully deduct research and development costs and equipment purchases in the year they happen. This encourages companies to reinvest in their operations more quickly and can lower their tax bills right away. For entrepreneurs and business owners who have ample cash on hand and a large tax bill, this could be a great time to reinvest.

BBB also increases tax credits — up to 35 percent — for advanced manufacturing investments. This includes semiconductors, batteries, critical minerals like lithium and cobalt, and advanced energy technology.

Companies to consider:

Nvidia (Ticker: NVDA)

Vertiv Holdings (Ticker: VRT)

Applied Materials (Ticker: AMAT)

Affordable housing

The Opportunity Zone program is getting expanded, making it easier for some rural areas to qualify. Opportunity Zone programs let investors defer or reduce capital gains taxes when they reinvest profits into designated low-income communities.

There’s also an expansion of Low-Income Housing Tax Credit’s. This is the largest federal program supporting affordable rental housing. More credits means more affordable housing projects and more opportunities for investors, especially in real estate investment trusts (REITs) focused on housing.

Investment to consider:

Invitation Homes Inc. (Ticker: INVH)

American Homes 4 Rent (Ticker: AMH)

Agriculture and commodities

The bill sets minimum price levels, also called price supports, for crops like wheat, corn, soybeans, peanuts, barley, and more. These price floors are locked in through 2030, with small annual increases starting in 2031. This is good news for companies tied to agriculture and food production because it helps stabilize farmers’ income. You combine this with the business investment expensing that I mentioned above and you get a nice setup for farming equipment manufacturers.

Companies to consider:

Deer & Co. (Ticker: DE)

Caterpillar (Ticker: CAT)

CNH Industrial (Ticker: CNH)

This bill is a clear signal about where the government wants to channel energy over the next several years into defense, manufacturing, AI, housing, and agriculture.

If you’re thoughtful about aligning your portfolio with these themes, you can position yourself to benefit from the tailwinds. Of course, your next move depends on your goals and risk tolerance. But knowing where the opportunities are makes it much easier to build a smarter strategy.

If you want help thinking through how to put these insights to work, feel free to reach out.

Ken | just a guy with a passion for breaking down markets in a way that speaks to our culture.